Time to be your own boss

Join the thousands who launched their U.S. businesses with LegalHoop

LLC/INC plans start at $49 + state fees.

Start your business

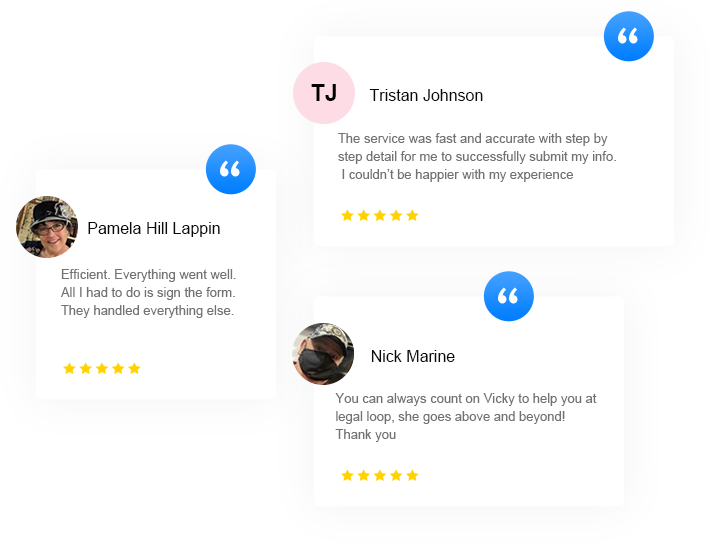

Ethan C., empowered by LegalHoop

James Martin, empowered by LegalHoop

Karina, empowered by LegalHoop

Anna Wong, empowered by LegalHoop